Texas Franchise Tax Reporting: Step by Step

Unfortunately, it is that time again. You may already be aware that, in order to remain compliant with state law, Texas requires annual tax filings. Each year, Corporations and LLCs must file the Annual Franchise Tax Report and the Franchise Tax Public Information Report. This year, the deadline is May 16, 2022.

Helpful (and complimentary!) information below:

Franchise Tax Report

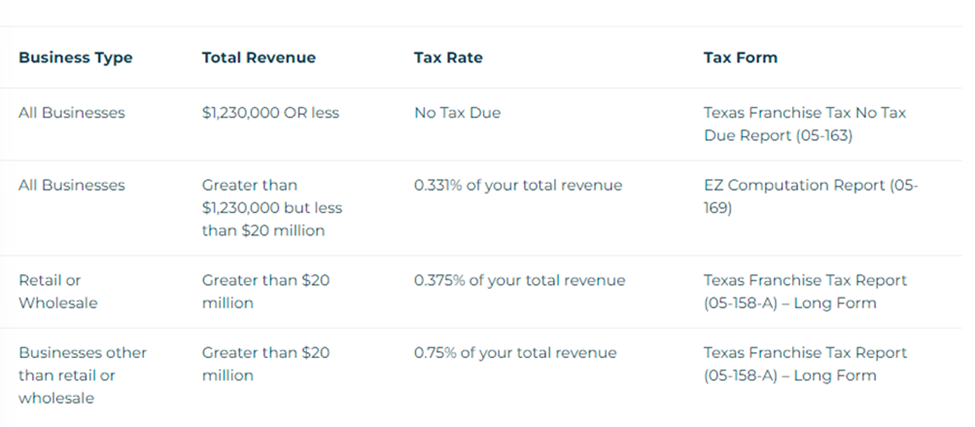

This report is submitted to the Texas Comptroller of Public Accounts each year, even if you do not owe any taxes. The tax rate is based on the revenue earned. The amount due to the Comptroller is based on the Company’s total annual revenue (please see the below table). This form can be filed online at: https://security.app.cpa.state.tx.us/ or by paper copy. (If filed online there is a $1 service fee.)

Franchise Tax Public Information Report

This report is submitted to the Texas Comptroller of Public Accounts each year along with the Franchise Tax Report. This report must be filed even if you don’t owe Franchise Tax Fees to the state. You can file this form online at https://security.app.cpa.state.tx.us/ or by paper copy. (If filed online there is a $1 service fee.)

The Franchise Tax Public Information Report must include:

-

- the name of each third-party entity in which the filing entity owns a 10 percent or greater interest, and the percentage owned by the filing entity;

-

- the name of each third-party entity that owns a 10 percent or greater interest in the filing entity;

-

- the name, title, and mailing address of each person who is:

-

-

- an officer or director of filing entity on the date the report is filed, and the expiration date of each person’s term as an officer or director, if any; or, if a limited partnership,

- the general partner of the limited partnership on the date the report is filed;

- the name and address of the agent* of the filing entity (for service of process); and

- the address of the filing entity’s principal office and principal place of business.

See Texas Tax Code 171.203.

-

*The Firm serves as process agent for a number of corporate clients. Please contact us if you need support.

Repercussions for Late Filing

There are significant consequences for not filing on time.

1. Immediate Penalty: the Comptroller will assess a $50 penalty fee.

2. Additional Late Fee:

-

- 1-30 days late: an additional 5% of the total tax due.

-

- over 30 days late: an additional 10% of the total tax due.

3. Forfeiture of Corporate Status: in addition to the monetary penalties, the Comptroller can strip a company’s corporate and limited liability protections for failing to their franchise tax report. The Comptroller will send you a notice that you have failed to file; you have 45 days from the day of posting to file your tax return before the Comptroller strips away your company protections. The only way to rectify this situation and restore your corporate and limited liability protections is by filing all reports and paying all fees and taxes.

We would be happy to help you with the above or simply provide you with more guidance. Please let us know if you have any questions or concerns. Have a great weekend!